DOWNLOAD EPF CLAIM FORM 10C

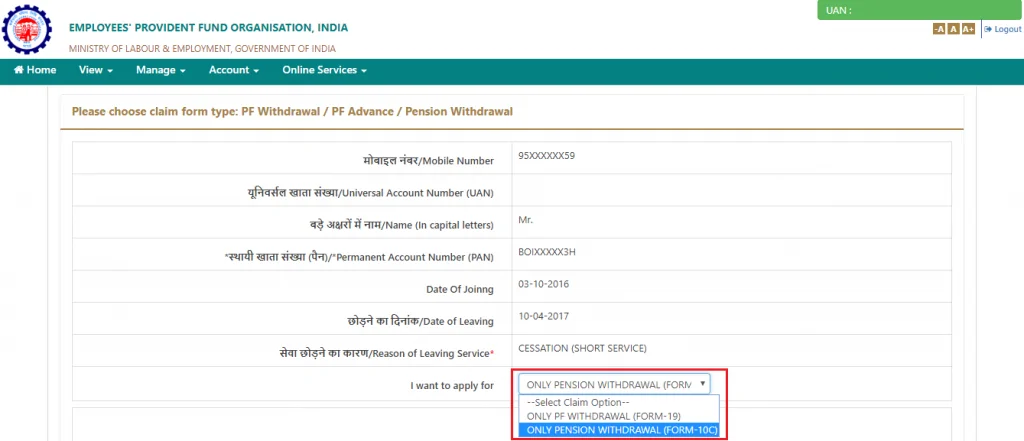

It is worth noting that all options for which the employee is not eligible for withdrawal will be mentioned in red. If you want to withdraw the pension amount, Form — 10C should be filled. If an EPF withdrawal is made after 5 years of service, the same is not taxable. The pensionable salary is capped at Rs 15, and service period at 35 years. Other online services such as eKYC, contact details update, etc.

| Uploader: | Juktilar |

| Date Added: | 19 May 2016 |

| File Size: | 24.63 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 63360 |

| Price: | Free* [*Free Regsitration Required] |

Users can find the Form 10C for claiming refund of employer share, withdrawal benefit, scheme certificate for retention of membership. It's the portion of the employer's contribution that moves into the EPS.

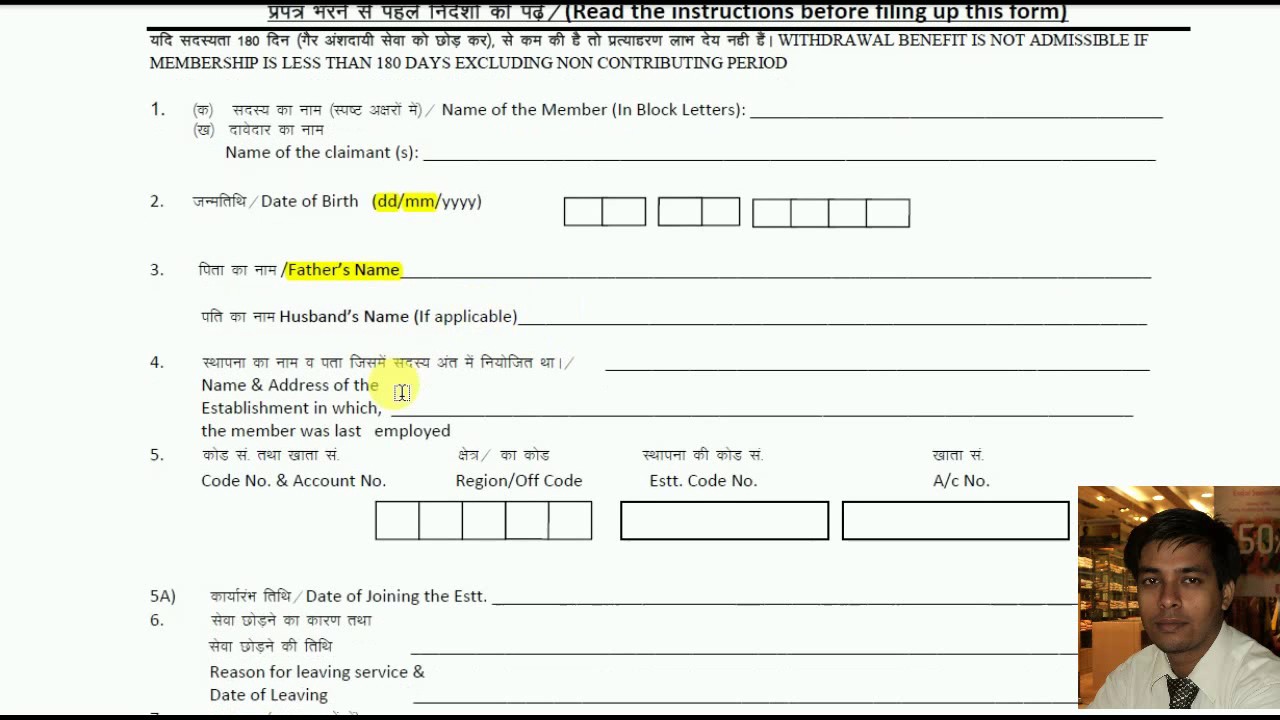

Users must read the particulars in the form and fill up as per the instructions.

This form can only be used by an individual who has furnished employee details to the existing employer in 'Form New' download herefurnishing the Aadhaar, bank details, and after getting the Universal Account Number UAN activated by providing a cancelled cheque with name, account number and IFS Code. Click here for real-life stories of successful investors. It is also considered as the authentic record of service as it contains the employment history of the member.

Instantly download your 80C investment proof Zero Commission. When you leave the job, you will again have to fill Form 10C.

EPFO FormC for claiming withdrawal benefit/scheme certificate | National Portal of India

The employer is supposed to match the employee's minimum contribution of 12 per cent. Form 10C contains following sections that a member has to fill at the time of applying epc pension withdrawal:. Users need to provide details such as name, email id, address, phone number and IP no. Home Saving Schemes List: You can make a withdrawal claim by filling the EPF withdrawal form online.

One can also check caim the EPF claim status and balance in account. The status will be displayed on the screen automatically. Users can get information on the Act, its objectives, short title and commencement. An employee contributes 12 per cent of his basic pay towards the EPF account.

Details of eligibility for membership, members' benefits, registration, etc. Once the claim is processed, the amount will be transferred into forrm bank account. How much pension amount will I get if I withdraw the fund? Therefore, new employees whose basic pay is more than Rs 15, will not see any diversion of 8.

Form 10C - Eligibility, Benefits, Attestation, Documents

This, however, depends on the length of his service and his age. EPF withdrawal is exempted from tax if withdrawn after a service period of 5 years.

In case you want to use the online method, you will have to login to the EPF member portal using your UAN and password. Information related to sections of the act is also given.

The EPS fotm can be withdrawn by an employee or it can be carried forward through a scheme certificate while switching jobs. In case you want to withdraw the pension amount instead of transferring it to the new account, follow the steps mentioned below:. However, the accumulated pension amount can be withdrawn using Form 10C after days of continuous service and before completion of 10 years of the service period.

EPFO Form-10C for claiming withdrawal benefit/scheme certificate

The fields in this form are similar to that in Form If he is still working, but hasn't completed 10 years, this, however, is not possible. A member can withdraw the pension amount when he switches a job at least after 6 months of continuous service and before completing 10 years of service period.

To be eligible for pension for lifetime and then family pensionone has to work minimum 10 years and then keep accumulating service period through scheme certificates. Invest in just 5 minutes. Let's see how much pension one could get after the hard times of a working life. You do not have to enter any reference number to check the status. The pensionable salary is capped at Rs 15, and service period at 35 years.

In the event of death of member, this form is to be used by a nominee or clsim member to claim the member's Provident Fund accumulation.

Комментарии

Отправить комментарий